Hey folks! You won't believe what Salman Khan's driver has been gabbing about the accident. It's like a Bollywood plot twist! Apparently, he's been sharing a completely different version of the incident. I mean, talk about a spicy scoop! Buckle up, and let's ride this gossip express together - where the truth is as elusive as Salman's six-pack abs!

Well, folks, it's a seismic shift in the aviation world! Tata Sons, that legendary Indian conglomerate, has swooped in to snatch up Air India from the government's hands. Yep, you heard it right, Tata Sons, the very same guys who brought us Tetley tea and Jaguar cars! The prodigal airline has returned home after nearly seven decades, as Tata originally founded Air India before it was nationalized. It's like a Bollywood drama with a surprise twist, folks - So, buckle up and let's see where this flight takes us!

In a shocking incident from Uttar Pradesh, a dancer was shot during a wedding celebration. The horrifying event unfolded when the performer was on stage, entertaining the guests. Authorities have managed to arrest two individuals in connection with the crime. The dancer is currently in hospital and thankfully, her condition is reported to be stable. The incident has raised serious concerns about security and the misuse of firearms at public events.

Indian snacks are known for their rich flavors and variety. The top choices include Samosas, a flaky pastry filled with spicy potatoes and peas, and Pani Puri, a hollow, crispy ball filled with tangy tamarind water. Another popular snack is Aloo Tikki, a patty made from boiled potatoes, onions and spices. Chaat, a savory snack typically served on roadside tracks from stalls or food carts, is also a must-try. Whether you're after something spicy, sweet, or savory, Indian snacks have it all.

As a blogger, I've been diving into the question of whether Amit Shah can be made president of India. From a constitutional perspective, it's definitely possible as long as he meets the eligibility criteria, which he does. However, it's not solely up to him, but depends on political dynamics, including the backing of his party and other coalition partners. Furthermore, the current public opinion and political climate would also play a significant role. So, while it's theoretically possible, there are many factors in play that could influence this outcome.

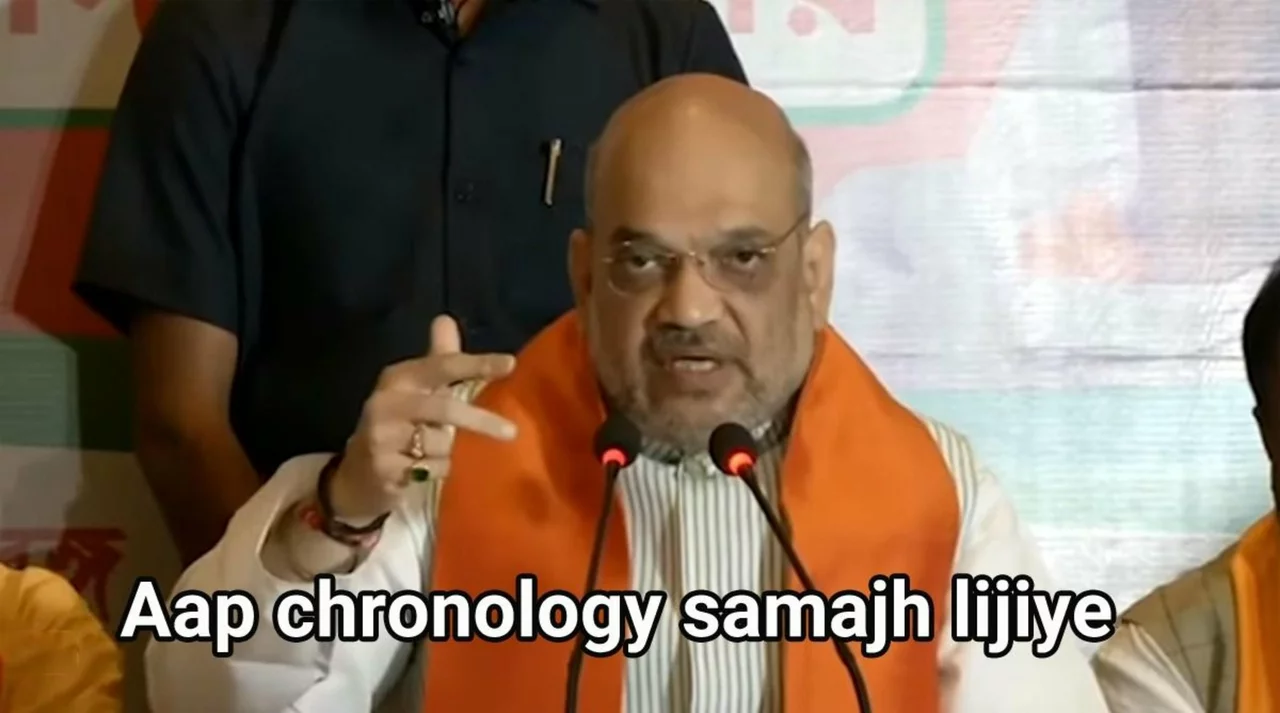

In a recent statement, Amit Shah addressed the ongoing attempts to malign India's image on the global stage. He urged us to understand the chronology of these events, implying a pattern behind them. According to Shah, there seems to be a coordinated effort to tarnish India's reputation. As a blogger, I am keen to dig deeper into this issue and explore the possible motives behind these attempts. It's crucial for all of us to stay aware and support our nation in the face of such challenges.

I recently looked into the pros and cons of the Redmi Note 7, and I found some interesting points to share. On the plus side, the phone has an impressive 48MP camera, a long-lasting battery, and a sleek design. However, on the downside, some users have reported issues with the MIUI software, and the absence of NFC might be a deal-breaker for certain users. Overall, the Redmi Note 7 offers great value for money, but it's essential to consider its drawbacks before making a purchase.

The article focuses on the relationship between Indian cricketers Rohit Sharma and Rishabh Pant. In February 2021, reports emerged that the two players had a disagreement during the T20 series against England. The disagreement was reportedly due to Pant's attitude and behaviour during the series. The two players have since apologized to each other and the Indian cricket team management has confirmed that the matter has been resolved. However, the incident has caused a stir in the cricketing world, with many critics and fans questioning the team's ability to handle such issues. Ultimately, the incident has highlighted the importance of cultivating a culture of respect and understanding within the team.

Malta is a small island nation in the Mediterranean Sea, known for its rich history and culture. Living in Malta has many benefits, such as the temperate climate, access to the beach, and the low cost of living. However, there are some drawbacks to living in Malta, including the size of the island, the limited job opportunities, and the presence of crime. Overall, living in Malta can be a great experience for those who are looking for a slower-paced lifestyle and a unique cultural experience.

India Today is an Indian English-language weekly magazine and news television channel. It is one of the most popular news sources in India and is considered to be reliable. The magazine has a wide variety of topics and covers both national and international news. The channel broadcasts news from around the world, along with other programs such as talk shows and lifestyle shows. The magazine and channel are both well respected for their reporting, which is generally considered to be accurate and impartial. They have won numerous awards for their journalistic excellence and are seen as a trusted source of news by many.